Here's an excellent article from Medical Office Today on things to consider when evaluating whether you should renovate existing space or build new.

To Renovate or Build New: Factors to Consider

May 29, 2013

By Carrie Rossenfeld

Whether you’re just starting out as a healthcare provider or are a seasoned professional, at some point the question of whether to renovate a space or build a brand-new office may arise. The bad news: there is rarely a cut-and-dried answer to this question. The good news: there are many factors to consider that will help you decide what to do.

“The renovate vs. build new question is a base starting point for any practice to consider,” says Andrew Quirk, senior vice president and national director of Skanska USA Building’s Healthcare Center of Excellence in Nashville, Tenn. “The space a practice operates within can mean the difference between a business’s healthy margins and losing money. Additionally, the physical environment has a direct impact on the practice’s brand, patient attraction and retention, employee attraction and retention and operational efficiency.”

Quirk says that if these topics are not on a practice’s radar, they need to be. “A practice really needs to ask the question of what are we trying to achieve, what are we trying to do as a practice? Sometimes the response is simply a freshening of the brand that can be achieved through new finishes and furniture; others may identify a growing practice or a need to be more efficient as the reasons for change. In either scenario, the needs will point in the right direction for either a renovation project or new construction.”

Quirk adds that larger issues like a changing patient demographic base or adding partners to a practice can also point a group in a particular direction.

Any decision to renovate an office or build a new building provides an opportunity to reinvent your practice internally and externally, says Fred Wolters, planning and design principal at EYP/BJAC, an architecture firm specializing in academic, medical, research and government clients in Raleigh and Charlotte, N.C. “These opportunities do not come along often and, given the changing world of healthcare we live in, it is more important than ever that medical practices take advantage of them.”

"Your decision also matters since it could affect the financial health of your practice for years to come," says Ken Kaplan, president of Kaplan Construction in Boston. “Depending on the work program decided upon, the project could become a major distraction for the practice for an extended period.”

Typically, practices contemplate construction to accommodate growth, which is solved with additional square footage, says Bradley Cardoso, a senior associate at Margulies Perruzzi Architects in Boston. This could be achieved with either option, but “the decision should be based on construction cost, disruption caused by construction and the quality of the final layout. Ask the question: Does the solution provide value to the patients for the cost?”

The benefits of each choice

Renovation

Renovation can at times provide a “best of both worlds” result, says Quirk—lesser costs, coupled with varying degrees of solutions to basic efficiency issues and physical upgrades. He adds that renovation projects are also scalable and scope can be adjusted to meet a practice’s budget, which offers you a variety of options. With renovation, users can more easily reach the correct decisions for their practice, adds Kaplan.

“If minor changes are needed due to patient-care delivery changes, then renovation may solve the issues,” Cardoso points out. “However, that’s only if there is enough space to make the changes or there are rooms that can be converted for the new use.”

According to Tim Gaumond and Rich McClelland, architects with Larson & Darby Group in Rockford, Ill., other benefits of a renovation include:

· Quicker build out and move-in time

· If leasing, your landlord will take care of the common areas, exterior, etc.

· You already are familiar with complementary practices and services in the or area

· More flexibility in moving to a larger or smaller space when a lease expires

· Quicker permitting, less zoning and site reviews

And Cardoso adds:

· There’s no need to move.

· You can save what works, therefore saving money on construction.

Building new

Building new allows a practice to correct wrongs or basically create a fresh start, says Quirk. Kaplan adds that with a new build, new technologies, growth and staffing issues in general can more easily be addressed. “A ‘new’ office might present an image of better professional and patient outcomes to the community.”

Gaumond and McClelland say the benefits of building new include:

· Ultimate flexibility in layout and design

· The exterior projects the image the practice wants to convey.

· You have control of the common areas (i.e., lobby, restrooms, etc.).

· You could lease areas of the new building that you’re not using to generate revenue.

· You gain the benefits of a long-term real estate investment.

And Cardoso adds:

· A shorter schedule with fewer phases

· A new space will meet current health and building codes

· No disruption to the current practice (i.e., noise, vibration, system shut-offs)

· Greater efficiency because builders don’t have to work around an operating office

· New space is more efficient and gives the practice an opportunity to evaluate and change current patient/staff flow

Wolters sums up that while in most circumstances the same goals can be achieved either through new construction or renovation, new construction typically comes with fewer built-in constraints than those related to existing building systems and structure. “Additionally, it offers the potential benefit of more or better location possibilities, which results in the ability to more publicly display or reflect the brand. More potential locations could help get the practice closer to a demographic market or professional affiliates.”

Disadvantages to each choice

Renovation

One of the biggest disadvantages to renovation is the disruption it causes to a practice’s normal work flow, say the experts. Also, design solutions can be limited due to existing building details such as structure, building systems and complex phasing, says Cardoso. More-expensive after-hours construction may be needed to maintain a comfortable patient environment during business hours.

Renovation projects can also be messy, says Quirk, and Wolters says flexibility is lessened in a renovation. “If you have a custom design that does not fit the space or is needed in a different location, renovation will not be an option for you.”

Renovation may also bring up the issue of outdated wiring and structuring, or failing to meet dated code and zoning regulations—problems that building new will not have, Wolters points out.

Gaumond and McClelland list the following disadvantages to renovation:

· Limits on the layout

· Handicap accessibility may not be totally up to code in an older building

· Building services, electrical, heating and cooling, and ventilation capacities may limit the function of the space

· Retrofitting spaces to your needs may be expensive or limited

· You may have costly removal of hazardous materials

Building new

New buildings, on the other hand, often require more square footage because of increased building- and health-code requirements, Cardoso says. Because of this, room sizes are often increased, increasing travel distance for staff and patients.

Also, construction of a new building usually comes with many more decisions, says Kaplan. “The design and construction process can be protracted getting the correct balance of design and budget.”

And, an entirely new structure means that everything used in construction will have to be purchased, and those costs can add up quickly, Wolters says. In addition, there can be costs associated with new construction that you may not be aware of, such as legal fees, transactional real estate fees and related expenses, says Quirk.

“New construction can completely respond to operational inefficiencies, but often requires a bigger cost to implement,” Quirk points out. “Starting with a blank sheet of paper can also be daunting as there can be so many variables and requires a team to help lead a practice through the process of planning and executing.”

Other disadvantages to building new that Gaumond and McClelland list include:

· Land will have to be acquired, which may limit location

· Construction time will typically be longer

· Unforeseen conditions may cause additional costs to the project

· More time and input from providers may be needed

· Overall cost may be greater

· You may be taking on additional responsibilities as a building owner and landlord with regard to maintenance and upkeep.

Final thoughts

Both renovations and new building projects typically take longer and cost more than what was initially estimated, say the experts. Establish a detailed and realistic budget and schedule early in the planning stages of your project, Wolters advises. “Do not fall into the trap of thinking that because you are renovating or creating a new building that you need all new furniture and equipment. Chances are that what you are using currently will continue to serve a good purpose in your new space, as well as saving the money it would cost to purchase new items and the time it would take to order and receive them.

Also, carefully and accurately estimate the time and cost of relocation for your staff and operations, as well as the time and cost associated with relocation or installation of data and communications, Wolters says. “These are easy things to underestimate and a common mistake.”

And involve your staff in the decision-making process, since it will directly affect them on a daily basis, Wolters suggests. “They can be invaluable resources and have great insight and perspective into what will be helpful and best for your business because of their firsthand knowledge of the way your organization works.”

Labels: developer, healthcare, healthcare development; healthcare real estate, hospital renovation, hospitals, medical groups, medical office, medical office space, MOBs, real estate

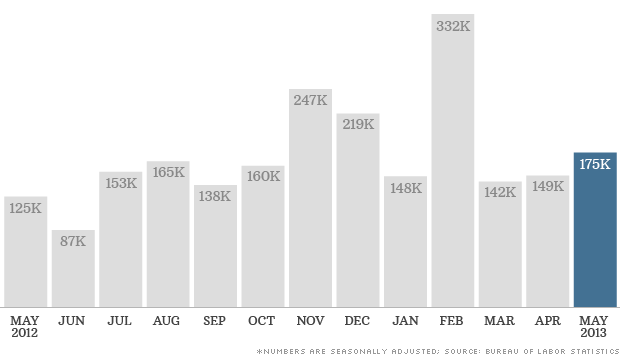

The U.S. economy added 175,000 jobs in May, in line with average job growth over the prior 12 months.

The U.S. economy added 175,000 jobs in May, in line with average job growth over the prior 12 months.